Document Required for Udyam Registration

Udyam Registration, also known as the Udyog Aadhar Registration, is a process for registering small and medium-sized enterprises (SMEs) in India. It is a simplified, online process that allows businesses to obtain a unique identification number called an "Udyam Registration Number."

There are a number of benefits to obtaining an Udyam Registration Number for your business. Some of the key benefits include:

Simplified compliance with government regulations: Udyam Registration streamlines the process of complying with various government regulations, such as tax compliance and labor laws.

Access to government schemes and incentives: Many government schemes and incentives are only available to businesses that are registered with Udyam.

Increased credibility and visibility: An Udyam Registration Number can help increase the credibility and visibility of your business, as it demonstrates that your business is legitimate and registered with the government.

Enhanced access to credit: Some financial institutions may require Udyam Registration as a pre-requisite for lending to small businesses. Obtaining an Udyam Registration Number can make it easier for your business to access credit.

Eligibility for Udyam Registration

To be eligible for Udyam Registration, your business must meet certain requirements. These requirements include:

- The business must be a small or medium-sized enterprise (SME) as defined by the government of India.

- The business must be located in India.

- The business must be engaged in a manufacturing, trading, or service-based activity.

- The business must be owned by Indian citizens or entities.

There are a number of different types of businesses that are eligible for Udyam Registration, including:

- Sole proprietorships

- Partnerships

- Private limited companies

- Limited liability partnerships

- One-Person Companies (OPCs)

- Hindu Undivided Family (HUF) businesses

It is important to note that businesses that are not eligible for Udyam Registration include:

- Government companies

- Public sector undertakings

- Co-operative societies

- Foreign companies

- Not-for-profit organizations

If your business meets the above requirements and is not excluded from Udyam Registration, you may be eligible to obtain an Udyam Registration Number.

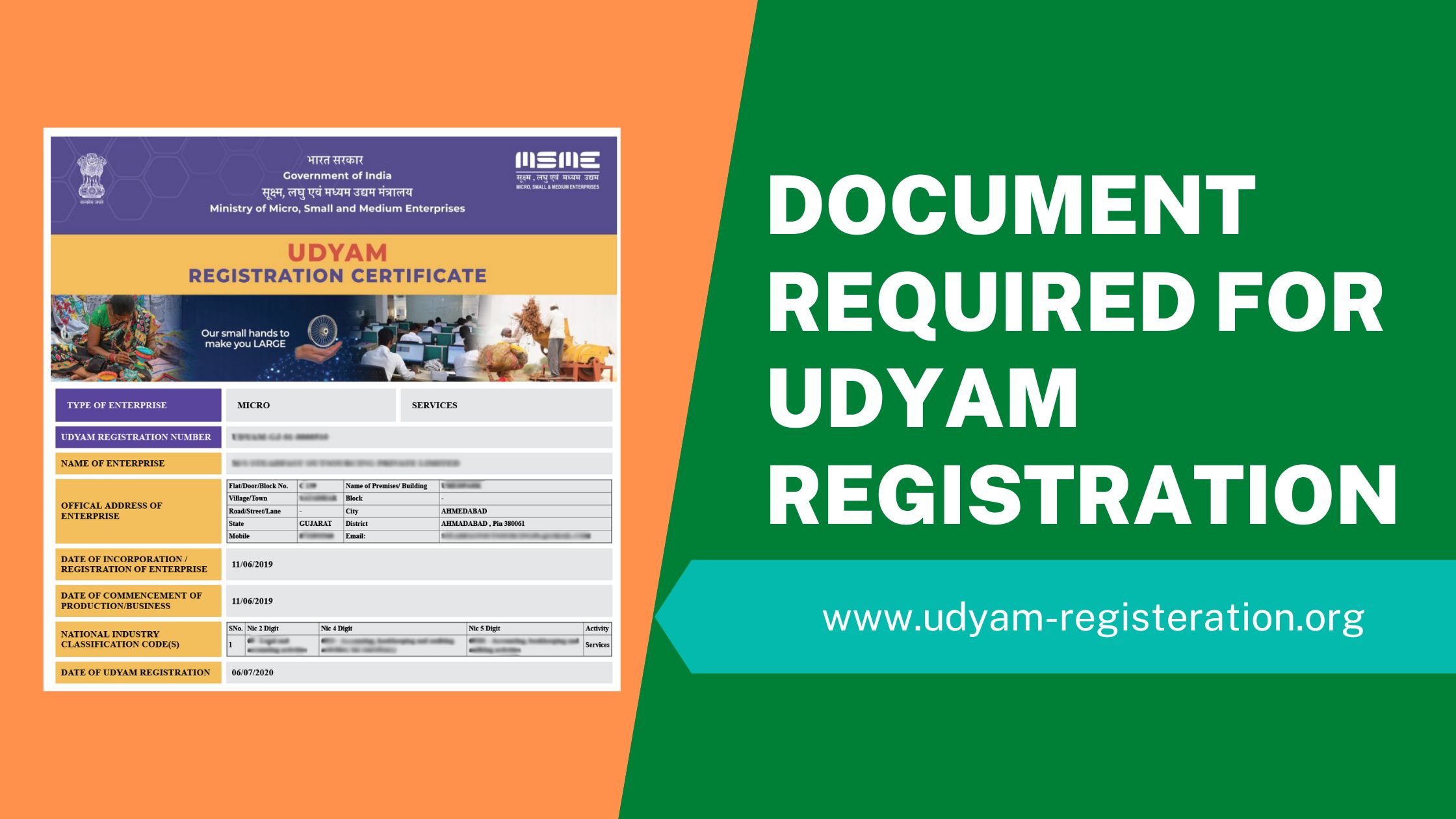

Documents required for Udyam Registration:

To complete the Udyam Registration process, you will need to provide certain documents to the government. These documents include:

- Proof of identity: You will need to provide proof of your identity, such as a PAN card or Aadhaar card.

- Proof of address: You will need to provide proof of your business's address, such as a utility bill or rental agreement.

- Business registration documents: Depending on the type of business you have, you may need to provide business registration documents, such as a partnership deed or articles of association.

- Proof of business activity: You will need to provide proof of your business's activity, such as invoices or GST returns. This helps the government verify that your business is operating and generating revenue.

It is important to note that the specific documents required for Udyam Registration may vary depending on the type of business you have and your location. Be sure to check the government's website for the most up-to-date information on the documents required for Udyam Registration.

Process for Udyam Registration:

The process for obtaining an Udyam Registration Number is relatively straightforward and can be completed online. Here is a step-by-step guide to the Udyam Registration process:

- Visit the Udyam Registration website.

- Fill out the udyam registration form.

- Review and submit your application.

- Make the Payment.

- The executive will call you to verify.

- you will receive an Udyam Registration Number and certificate in your email-id.

Be patient. The Udyam Registration process can take a few weeks to complete, so be prepared to wait for a response.

The Bottom Line

Small and medium-sized enterprises (SMEs) are registered through a process called udyam registration in India. Having an Udyam Registration Number has several advantages, such as easier compliance with legal requirements, access to government programs and incentives, enhanced credibility and visibility, and easier access to loans.

You must give the government specific documents, including proof of identification, business registration paperwork, and Name of business activity, in order to complete the Udyam registration procedure. Depending on your area and the type of business you run, several pieces of paperwork could be needed.